Is your sustainability strategy paying you back?

- sherry8120

- 5 hours ago

- 2 min read

If you're wrestling with how to turn your sustainability goals into tangible business value, keep reading as we discuss how asset-level analysis can help you prioritize actions with proven ROI.

⚠️ Most decarbonization strategies aren’t built for how companies actually operate

Only 35% of companies are on track to meet their own emissions-reduction goals, according to CDP’s 2025 Corporate Health Check 1 . Why?

In our work with sustainability leaders, we often find that decarbonization strategies aren't grounded in operational reality.

Many sustainability and decarbonization plans start with the big picture: grand ambitions and long-term goals. While these help to set the direction of travel, they lack the specificity needed for concrete progress.

A 2024 Conference Board survey backs this up: 60% of sustainability executives at large U.S. companies say that organizing and implementing their sustainability strategy is their number-one challenge 2.

🔍Actionable, high-ROI decarbonization starts at the asset level

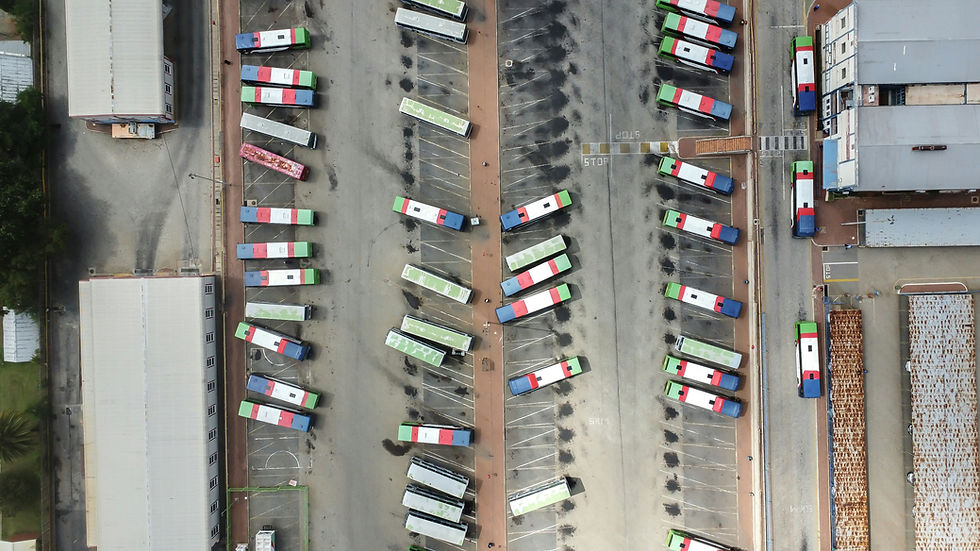

At Rappel, we work with companies to connect their ambitions directly to the assets that use energy and generate emissions – HVAC systems, fleets, process equipment, and more.

Each asset’s age, location, and operational use influences both its emissions impact and the economics of potential decarbonization actions.

When companies build strategies without asset-level understanding, we see them overinvest in low-impact projects and miss high-return opportunities hiding in plain sight.

🎯Why “electrify the forklifts” isn’t an actionable strategy

In one recent example, we were working with a global manufacturer under pressure to reduce the carbon intensity of its products.

Consider two of their warehouse forklifts, one in South Carolina and one in Missouri.

Using Rappel’s proprietary CO2-AIM model to run the numbers, we discovered that electrifying the South Carolina forklift reduces emissions and saves money, whereas electrifying the Missouri forklift delivers no meaningful emissions reduction and increases cost. Why?

In this case, the difference comes down to utilization and fuel price. The South Carolina forklift runs about five times more hours per year and has higher propane prices, making electrification a clear win. In contrast, the Missouri forklift doesn’t run enough to justify the investment.

With this asset-level clarity, the manufacturer was able to focus its small team and limited capital on the handful of actions that created large emissions savings and tangible payback.

🛠️ We built Rappel to make asset-level analysis practical for lean teams

If you’re nodding along but thinking, “Asset-level analysis sounds right, but also sounds like months of spreadsheet work we don’t have time for,” we get it.

That’s why we built CO₂-AIM (Carbon-Optimized Asset Investment Model) to scale asset-level analysis across your operations and generate decision-grade outputs without the overhead.

If you’re just getting started, we build an accurate emissions baseline that reflects your operations at an asset-level.

If you’re ready to act, we build a concrete decarbonization roadmap from asset-level analysis identifying where emissions are concentrated, testing levers asset-by-asset to quantify cost, payback, and CO₂ impact. We then map actions to your operational timelines so your team can execute effectively.

1. CDP, 2025 Corporate Health Check, January 2025.

2. The Conference Board, Corporate Sustainability Priorities for 2024, 2024.

Comments